Exclusive Privileges & Global Access

Unlock exclusive privileges and unparalleled travel and lifestyle benefits with GBTI’s premier credit card, offering the highest limits and global acceptance.

Key Features:

Higher Limit:

Up to US$50,000.

Lounge Access:

10 free airport visits/year (1,000+ lounges in 600 airports worldwide).

Global Network:

Accepted wherever Mastercard is recognized; Competitive FX rates.

Security:

Instant transaction alerts; 24/7 card blocking for loss/theft; Mastercard 3D secure.

Convenience:

Free monthly e-statements; Easy online bill payments.

Black Card Advantages

Features

Benefit

Travel Rewards

Premium App

High-End Merchant Discounts

Priority Service

Airline/hotel discounts

Highly rated mobile experience

Luxury shopping savings

Dedicated concierge support

Transparent Fees

Service

Fee

Card

Replacement

Cash

Advance

Cost

US$350

US$175/year

2%

(min. US$10)

Note: No statement fees – late payment fee: 1.5% of min. payment.

Eligibility & Requirements

Applicants must provide:

One Proof of Identification:

(National ID/Passport/Driver’s License)

TIN:

(TIN Certificate, Driver’s License, Payslip, GRA receipt, etc.)

Proof of Address:

Proof of Address

Additional for Credit Cards:

Statement of outstanding loans and/or hire purchase (if applicable)

Proof of Income:

(Salary Slip/ Job Letter/ Expenditure Statements for Self Employed Individuals)*

Frequently Asked Questions

Pinning your Mastercard

How to Set/Change Your GBTI Mastercard PIN

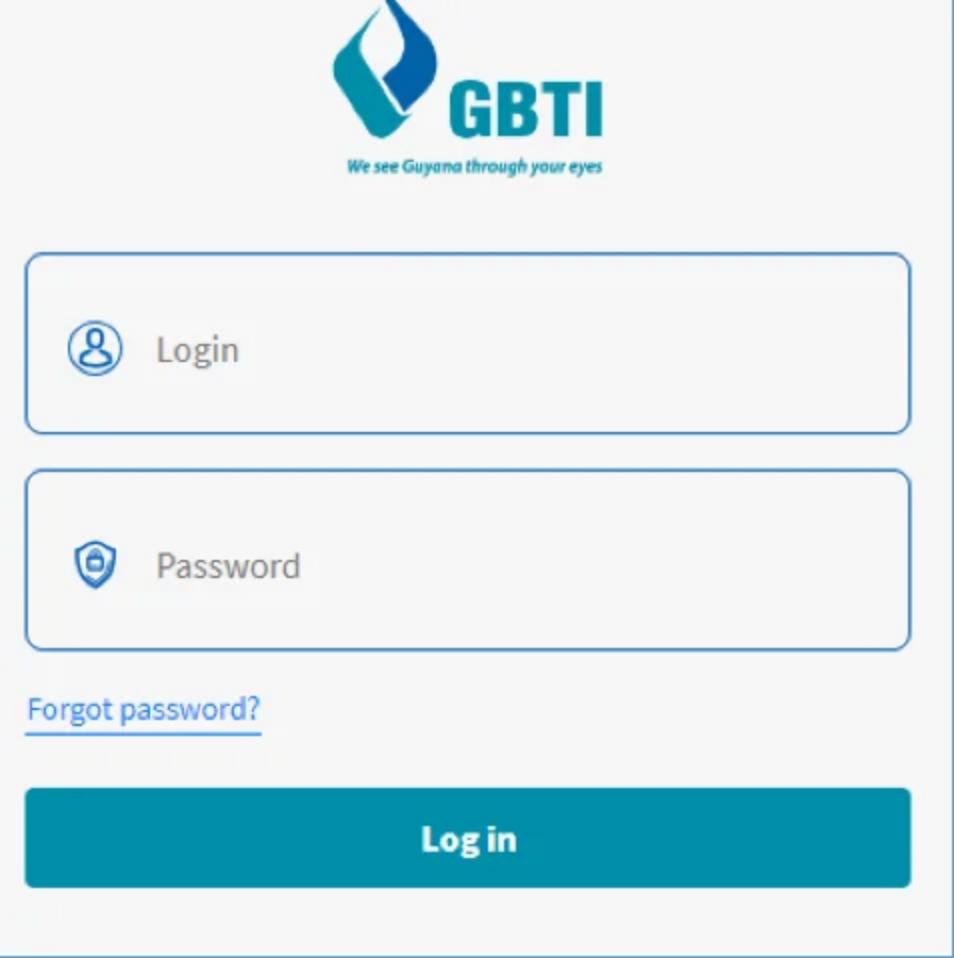

1. Access the GBTI Mastercard Online Portal

NB: User is your email address | Password is the last 7 digits of your card

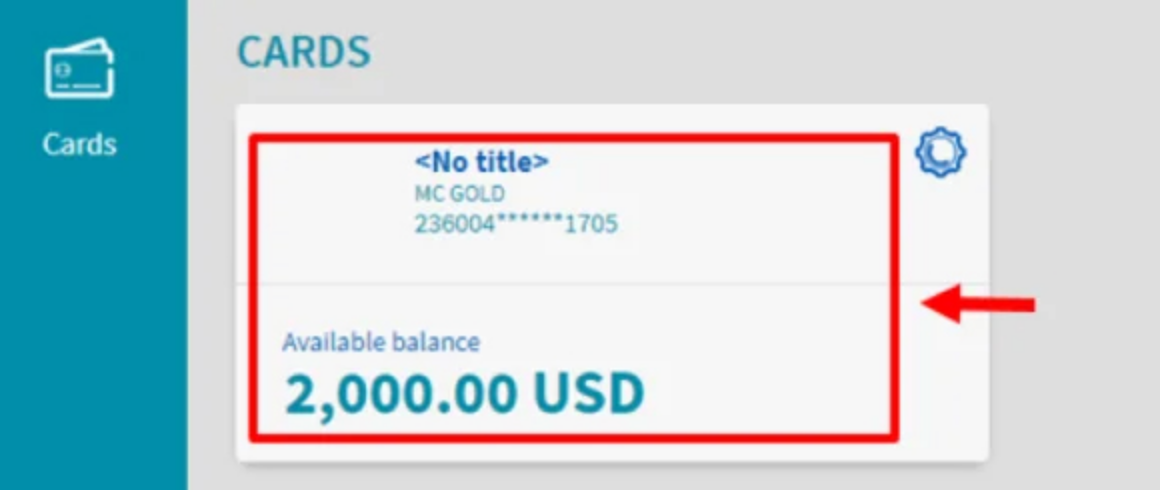

2. Click anywhere at the Card Tile, as highlight below:

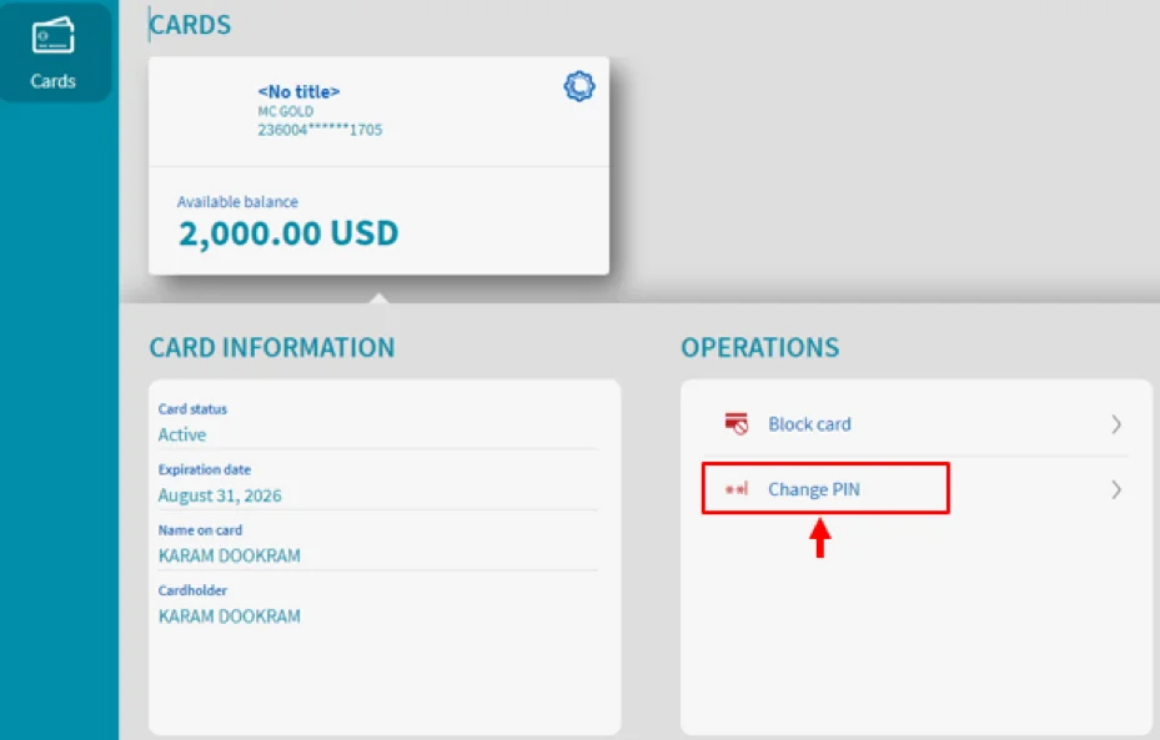

3. Select the OPERATIONS Tab, click Change PIN

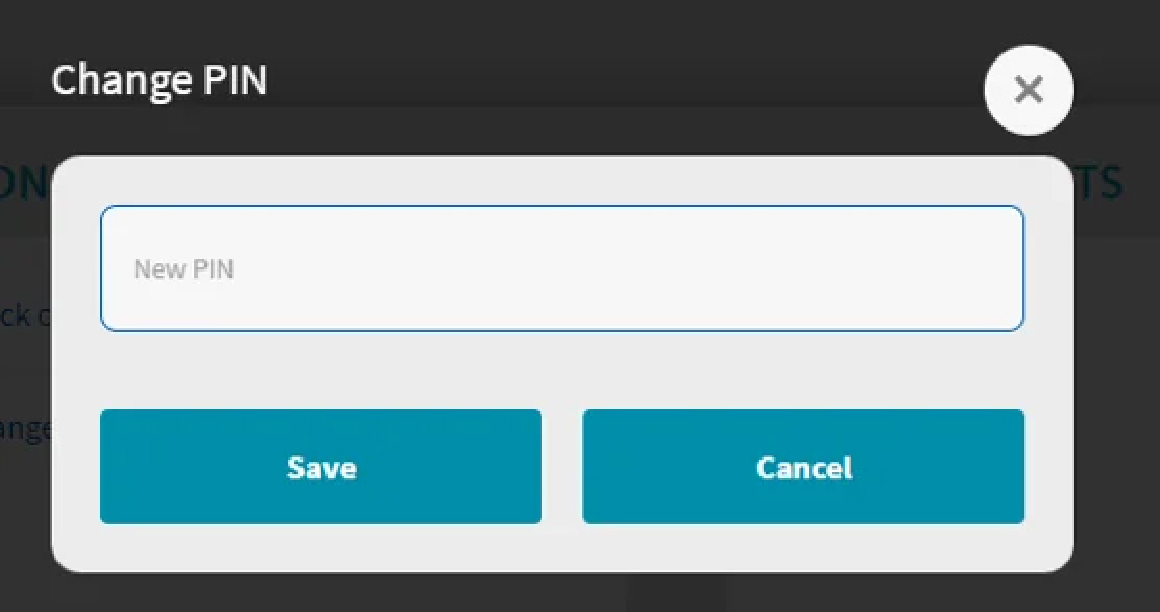

4. Enter your desired Card PIN

5. The screen will load for a few second then take the User to the Card Summary Screen.

Note: You will need a PIN to get cash from the ATM.

What is Mastercard Travel Rewards?

A qualifying transaction or eligible purchase is one where a cardholder makes a purchase that meets the cashback offer’s published criteria. These criteria include the use of an enrolled Mastercard at a participating merchant, paying in the specified currency, and satisfying all of the applicable terms and conditions stated in the offer’s advertising. Dynamic currency conversion transactions are not eligible for Mastercard Traveler Rewards offers.

What is a "qualifying transaction" or "eligible purchase"?

A qualifying transaction or eligible purchase is one where a cardholder makes a purchase that meets the cashback offer’s published criteria. These criteria include the use of an enrolled Mastercard at a participating merchant, paying in the specified currency, and satisfying all of the applicable terms and conditions stated in the offer’s advertising. Dynamic currency conversion transactions are not eligible for Mastercard Traveler Rewards offers.

Can I earn cashback from purchases in my home country with Mastercard Travel Rewards?

For all offers that are specified as “spend in-store”, you need to travel to the advertised destination to be eligible for the offer. For offers that are specified for “spend online” you can qualify for the offer in your home country provided you make a purchase using an enrolled Mastercard and at a participating merchant while using the offer’s specified currency and meeting all of the cashback offer’s applicable advertised terms.

Do I need to enroll in Mastercard Travel Rewards?

A qualifying transaction or eligible purchase is one where a cardholder makes a purchase that meets the cashback offer’s published criteria. These criteria include the use of an enrolled Mastercard at a participating merchant, paying in the specified currency, and satisfying all of the applicable terms and conditions stated in the offer’s advertising. Dynamic currency conversion transactions are not eligible for Mastercard Traveler Rewards offers.

Do I need to enroll in Mastercard Travel Rewards?

Yes. To enjoy the benefits of Mastercard Travel Rewards, Mastercard Black card holders must register with the program. You can register at the link below https://mtr.mastercardservices.com/en

All eligible cashback transactions will be processed automatically.

Do I need to enroll in Mastercard Travel Rewards?

Yes. To enjoy the benefits of Mastercard Travel Rewards, Mastercard Black card holders must register with the program. You can register at the link below https://mtr.mastercardservices.com/en

All eligible cashback transactions will be processed automatically.

How is the cashback processed? Do I need to do anything to make sure it is processed?

Mastercard will work directly with your bank to ensure all cashback payments from eligible transactions are processed without your involvement. Cardholders do not need to complete any forms. The processing of cashback offers is undertaken by Mastercard systems and presented as a credit on your card statement.

Is the cashback processed immediately at the point of sale?

The cashback is not processed immediately and will not reduce the purchase price of goods and services at the point of sale. The processing of cashback offers is undertaken quickly, but not instantly, by automated Mastercard systems, and appears as a credit on your card statement.

Is there a limit on the number of purchases I can make with each merchant brand?

The terms and conditions of each offer are specified on the program website. Simply check these terms and conditions on each offer as they have different validity periods.

What if I receive my card statement and I have not been credited any cashback from a qualifying transaction?

For cardholder support and enquiries related to Mastercard Traveler Rewards, please contact your bank. They will assist you with:

1. General enquiries and support

2. Transaction-related queries

3. Lost or stolen cards